Module 7: How to Earn a Passive Income Yield Farming

Yield farming may seem like a complicated concept; in this module, we will go through the principles of yield farming, how to get started, and more.

Getting Started with Yield Farming

The last module examined the basics of decentralized finance. This module will take a look at how to earn a passive income yield farming. The concept of yield farming can seem convoluted at first. But don't worry; in this module, we will go through the essentials below. We will begin by looking at what it is, how to do it, and why it might be worthwhile to investigate further. Let's get started!

When did Yield Farming Become so Popular?

Yield farming first gained popularity in 2020 because of protocols such as Compound and Aave. In addition, the value of digital assets locked in DeFi smart contracts also increased rapidly from $670 million to $13 billion in 2020. Today, more and more people worldwide are becoming interested in yield farming because of the attractive interest rates.

The Ethereum blockchain is the most notorious when it comes to yield farming. The market for decentralized finance is currently valued at more than $121.5 billion. Previously, the Ethereum blockchain had specific scaling issues. That is why several experts, like Vitalik Buterin, the founder of Ethereum, stated that he would not invest in yield farming until it has stabilized.

According to reports, yield farming cryptocurrency is flourishing, with investors seeing up to 50% profits last year, however, there is no upper limit. All that is required is good timing and the right underlying instrument to reap the benefits.

What is Yield Farming?

At its most basic level, yield farming is a method for cryptocurrency users to secure their assets while also earning incentives. It is, more specifically, a method of making fixed or variable interest by investing cryptocurrencies in a DeFi market.

Essentially, yield farming is the practice of lending cryptocurrency across a blockchain network. The amount lent is repaid with interest, similar to how banks give out loans to customers. The premise is the same as yield farming: a cryptocurrency that would otherwise be on an exchange or in a wallet is lent out to earn a return via DeFi protocols.

The Principles of Yield Farming Work

Adding funds to a liquidity pool, which are effectively smart contracts that hold funds, typically as a pair of two assets, is the first stage in yield farming. Liquidity pools are effectively the backbone of DEXs. These pools run a marketplace where users can buy, sell, and borrow tokens. Once you have added your crypto to a pool, you have officially become a liquidity provider.

A user will be rewarded with fees earned by the underlying DeFi platform in exchange for placing their money into a pool. It's important to note that yield farming does not include investing in a blockchain. Instead, yield farming is the practice of lending money over a decentralized money market protocol in exchange for a return.

Reward tokens can also be deposited in liquidity pools, and it's common for people to move their funds between different protocols to get higher returns. Yield farmers often move their funds between DeFi platforms to maximize their returns.

Now that we've covered the theory, you may wonder what this looks like in real life:

First, consider a market for DAI and USDC. Each of these coins is worth $1. You must first contribute an equal quantity of USDC and DAI tokens to start a USDC/DAI pool. For example, in a pool with only two DAI and two USDC, a single DAI would cost one USDC.

Following that, this pool would have one USDC and three DAI. The pool would be out of balance. By investing 50 cents in a single USDC, a user can obtain 1.5 DAI in return. That amounts to a 50% arbitrage gain, with the issue of limited liquidity. A trade of one DAI and one USDC would not affect the relative charge if there were 500,000 DAI and USDC of equal size. This is why robust liquidity is essential for any pool.

Understanding how yield farming works also necessitates a basic understanding of smart contracts, as they play an essential role. Here, smart contracts work as a link between your funds and the funds of other users.

Making money is the goal of any sort of lending, and crypto lending is no exception. For their services, a lender receives fees in the form of coins. Thus, yield farming is one of the most common ways to profit from cryptocurrency holdings.

Remember, yield farming is not easy money, and those who do best are often most experienced in the crypto and blockchain space. Also, those who supply liquidity are paid according to the quantity of liquidity they provide; thus, those who gain large rewards have proportionally large sums of money.

Although yield farming can currently offer a more attractive income than a regular bank, there are associated risks. Interest rates are variable, making it difficult to forecast what your rewards will be in the coming year—not to mention the fact that DeFi is a riskier environment in which to invest.

If you are an experienced crypto user and have a good tolerance for risk, yield farming could potentially provide an attractive passive income.

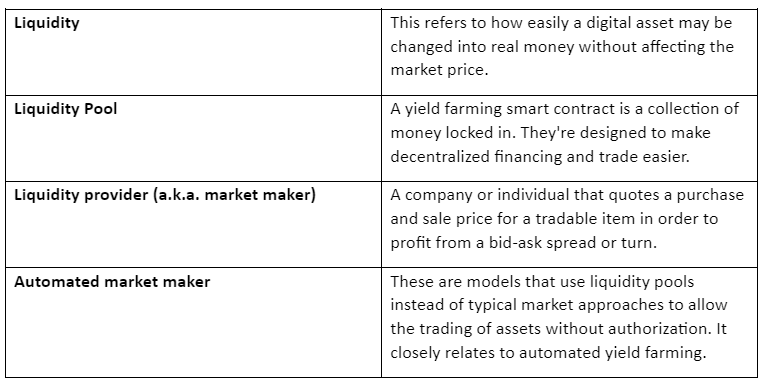

As a recap, below is a table of standard terms you are likely to encounter in the yield farming space:

Step-by-Step Guide on How to Quickly and Easily Begin Yield Farming

This is the exciting part. Below is a walk-through on how to begin yield farming. However, the below is not intended to be and does not constitute financial advice. It is always crucial to do your own research and consult a financial advisor before investing.

With that being said, let's get stuck in!

Step 1 – Buy BNB on Binance and Search for the Correct BNB/FIAT Pair: In this tutorial, we will be yield farming through Binance Smart Chain (BSC). Assuming you already have a Binance account, you first must purchase the currency from the Binance Smart Chain. This is the Binance cryptocurrency (BNB).

Once you are in your Binance account, click on "Markets." Then select "Spot Markets." Then look for the BNB/FIAT pair that corresponds to your country's FIAT currency.

Step 2 – Purchase BNB: Enter the amount of BNB on the right side of the screen after you've selected the correct BNB/FIAT combo. You have the option of placing a limit order (buying x BNB at a specific price) or a market order (buying BNB at the current token price). Once the purchase is complete, the BNB needs to be sent to a hot wallet. Metamask is a hot wallet that is easy to download and what we will use during this tutorial.

Step 3 – Download MetaMask: Once MetaMask has been installed, go to the upper right corner of your Chrome browser and click the MetaMask logo. Once you have accepted the terms and conditions, you can create your wallet - enter a new password and click "Create."

Step 4 – Connect Wallet to the Binance Smart Chain: The Ethereum "Mainnet," which is visible at the top of your MetaMask wallet window, is automatically connected to your MetaMask wallet. Because this guide focuses on the Binance Smart Chain, we'll need to add the BSC network to the wallet in order for it to connect to it.

First, Open your web browser and click the MetaMask extension at the top right. Once in the app, click on your account logo at the top right, then click on "Settings," and then "Networks." From there, you go to "Add Network" and then add Binance network's details.

Step 5 - Connect Your Wallet To The BSC Network: Before deploying your assets into Binance Smart Chain Network DApps, make sure your wallet is connected to the Binance Smart Chain Network. To do so, go to the top of your wallet and click on the current network, then Smart Chain.

Step 6 - Transfer Your BNB To Your Wallet: Next, you need to send your BNB to your wallet/

Click "Wallet" and "Fiat and Spot" in your Binance.com account. Next, click "Withdraw" and select BNB once you're in your wallet. Next, enter your wallet address. By clicking on your wallet address, copy your address and choose a withdrawal network.

Click "Withdraw" after entering the amount of BNB you want to send. Binance will now require you to complete some security fields in order to confirm the transaction.

Finally, check your wallet to see if your BNB has arrived. This may take a few minutes to process.

Step 7 - Adding the Cake token address to MetaMask: You must add the Cake token address to your wallet to check the quantity of Cake in your wallet.

To begin, open your wallet and scroll down to "Add Token."

In the "Contract Address Token" section, type the Cake token's contract address. Token addresses may be found at bscscan.com.

Once the address is entered, confirm it. Then, select "Add Token" from the drop-down menu.

The Cake token address has now been added to your MetaMask wallet. This is useful for checking how many cake tokens you have.

Step 8 – Swap BNB to Cake on Pancakeswap: You must first purchase Cake before you can farm it on Pancakeswap. This may be done by exchanging a portion of your BNB for Cake on Pancakeswap.

To begin, go to pancakeswap.finance and connect your wallet by clicking "Connect" at the top right corner of the page. In the left menu, select "Trade," then "Exchange." Enter the number of BNB you want to swap for Cake in the "From" column.

Then, in the "Select a currency" section, look for the Cake token. Pancake swap will now display the number of Cake tokens you will receive in exchange for the number of BNB tokens you entered.

Use your wallet to approve the transaction by clicking "Swap."

Step 9 - Stake/ Yield-Farm your Cake: If you wish to stake your Cake, go to "Pools" and select the Cake pool where you want to stake it. In the Cake pool, "Auto Cake" compounds your Cake profits. Finally, you can deposit your earnings into your wallet using "Manual Cake."

Once you have entered the amount of Cake you want to stake, you will need to approve the transaction through your wallet.

Step 10 – Start Yield Farming: In the menu to the left, click "trade" and then "liquidity." Click the "Add Liquidity" button once the new page has loaded. Select the CAKE and BNB token pairs to add to the liquidity pool. Using your wallet, approve the transaction.

Now, go to "Farms" and select the BNB-CAKE Liquidity Pool.

Add the desired amount of PLP BNB-CAKE tokens to the Farm and approve the transaction using your wallet. Then, by clicking on "Harvest," you can claim your Cake profits.

Congratulations, you have successfully begun yield farming!

Conclusion

Now you should have a good understanding of the basics of yield farming and how to get started. Yield farming is likely to become an efficient market with many opportunities to discover higher return rates than traditional methods. However, yield farming is not best suited to those who are new to crypto. Anyone who wishes to become more involved in yield farming should research the subject thoroughly.

In the next module, we will learn about decentralized exchanges.