Module 3: Evolution of Money and the Bitcoin Protocol

Module 3 is about the evolution of money and the Bitcoin protocol. It provides an overview of the history of money - from the days of bartering all the way up to the beginning of cryptocurrency.

In the previous module, we covered the basics of blockchain. Now, let's next take a look at the evolution of money and the Bitcoin protocol!

The History of Money – Bartering, Fiat and Digital Currencies

Bartering

Currency has come a long way since the days of bartering (exchanging goods and services). The history of known bartering dates all the way back to 6000 BC. With the bartering system, both parties needed to agree on the relative value of each item to physically make a trade.

While barter systems have dominated for most of history, money was eventually created as a method to denominate value to all things relative to this new asset type. People didn’t need to find another party that wanted the specific good that they wanted to exchange it for. Money took several forms over the centuries, ranging from metal to paper. Nowadays, most currency is often dealt with as an intangible electronic transaction through payment services or accessing your bank. Now, cryptocurrency is more popular than ever and makes digital value transfer immutable.

Money's physicality is probably its least important characteristic. Most economists agree that it doesn't even require a physical form in today's world. "The concept of currency has grown increasingly abstract, to the point where real coins and notes comprise only a small percentage of the money in existence," wrote David Orrell and Roman Chlupat in The Evolution of Money.

Banking and The Gold Standard

Paper money was first invented in China during the 9th century. Instead of constantly moving coins from one location to another, the Chinese authorities stored them all in one spot and replaced them with pieces of paper. This was the beginning of representative money, in which the money objects are not valued in and of themselves. Marco Polo brought this concept back to Europe from his travels in the East, giving rise to banking.

In this system, the representative paper money is still backed by commodity money in the form of precious metals. Gold and silver have been the most global emblems of riches for centuries. The United States government still keeps about 5,000 tons of gold at Fort Knox. A few hundred miles east, the Federal Reserve Bank of New York guards the world's largest gold depository. The vault contains over 6,190 tons of precious metal.

For centuries, the Gold Standard ruled the international economy, binding the value of currencies to gold. In the last century, however, governments began to separate the two. Fiat money, which has no fundamental value and is not backed by anything, has become the norm. Paper money is only valuable because the government says so, and only if citizens trust their authority.

Fiat Money

Firstly, fiat money is government-issued money that isn't backed by a physical asset such as gold or silver but rather by the government that created it. Fiat money's value is determined by the connection between supply and demand as well as the stability of the issuing government rather than the value of the underlying commodity. Most current paper currencies, including the US dollar, the euro, and other major global currencies, are fiat currencies.

Governments created fiat currency by minting coins out of a valuable physical item, such as gold or silver, or printing paper money that could be redeemed for a specific amount of a valuable physical commodity. On the other hand, Fiat is inconvertible and cannot be redeemed because no underlying commodity backs it.

Because fiat money is not linked to actual reserves such as a national stockpile of gold or silver, it is vulnerable to inflation and, in the case of hyperinflation, to becoming worthless. The inflation rate can quadruple in a single day in some of the worst cases of hyperinflation, such as Hungary following WWII.

Furthermore, if citizens lose faith in a country's currency, the currency will lose its value. This is in stark contrast to a currency backed by gold, which has inherent value due to gold's use in jewellery and the construction of technological equipment, computers, and more.

Cryptocurrencies, such as Bitcoin, have emerged over the past decade as a challenge to the inflationary nature of fiat currencies.

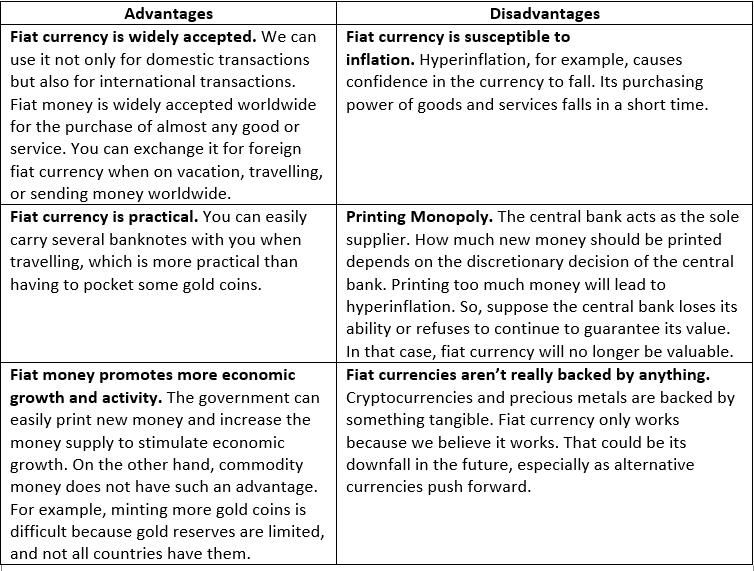

Overview of Fiat Currency's Advantages and Disadvantages

Just to recap, here are some quick points to remember when it comes to the advantages and disadvantages of fiat currency.

Bitcoin – The First Ever Cryptocurrency

Cash rarely ever needs to be exchanged these days. Instead, credit and debit cards have become a substitute for paper money in recent decades, and cryptocurrencies have triggered what may be the next financial revolution.

Bitcoin was the first-ever cryptocurrency that was created in 2009. The creator(s) behind Bitcoin remains a mystery. A person (or group) dubbed Satoshi Nakamoto uploaded a white paper to a cryptography email list in 2008. The white paper is considered the most seminal piece of work in the cryptocurrency movement.

Bitcoin is a form of digital money that uses blockchain technology to eliminate transactional third parties and allow for peer-to-peer monetary cross-border transactions while ensuring trust within the network.

Bitcoin Properties

To understand Bitcoin better, let's have a look at its five main properties:

Decentralisation

Bitcoin is a decentralised ledger that relies on cryptographic proof to enforce consensus in its network instead of third-party intermediaries.

Immutability

Bitcoin uses blockchain technology; once a transaction is added to the blockchain, it cannot be altered or deleted.

Borderless

It can be moved across the globe in a matter of minutes. To do the same in the fiat banking system can take days, sometimes even weeks. Furthermore, it requires you to give up a substantial amount of your privacy and requires permission from your bank and regulators.

Pseudonymous

It is not necessary to relinquish private information to participate in the Bitcoin network. While linkability (linking one's identity to their bitcoin address) is a major risk to privacy on the network, taking steps to remain private can be done on your own or with the help of third-party intermediaries.

Responsibility

Bitcoin comes with a certain degree of financial responsibility. If you happen to lose your Bitcoin key, you also lose your Bitcoin. In addition, nobody can reverse a transaction; this is referred to as the finality of settlement. This is in parallel to a centralised system where transactions can be reversed.

Bitcoin and the Double-Spend Problem

Double-spending is the risk that a digital currency can be spent twice. It is a potential problem unique to digital currencies because digital information can be reproduced by savvy individuals who understand the blockchain network and the computing power necessary to manipulate it.

Double-spending occurs when a blockchain network is disrupted, and cryptocurrency is stolen. This is known as double-spending. The thief will either send a copy of the currency transaction to make it appear legitimate or wipe the transaction entirely.

Double-spending does happen, but it is quite uncommon. Cryptocurrency being taken from an unprotected wallet, on the other hand, is far more likely.

The most common form of double-spending is for a blockchain thief to send several packets to the network, reversing the transactions and making them appear as though they never took place.

The double-spend problem is prevented in Bitcoin by the Nakamoto Consensus. This consensus is carried out through proof-of-work (PoW) and the timestamped servers.

As we discussed in the previous module, PoW is carried out by a decentralised network of 'miners' who secure the fidelity of the past transactions on the blockchain's ledger and detect and prevent double-spending.

The Bitcoin Protocol

In terms of transaction creation and validation, the Bitcoin protocol can be summarised as follows:

A new transaction is broadcast to all participating network nodes.

Each node converts new transactions into a block.

Each node tries to validate the new transaction as well as all prior ones by solving the block's Proof of Work algorithm.

The node that discovers the solution communicates the solved block to the rest of the network.

The transactions in the block are validated, and the nodes accept the block.

The nodes begin to work on the next block. The previous block's hash is constructed and used as a reference in the next block.

The Bitcoin protocol is predicated on the Bitcoin ledger being maintained collectively. The digital money is approved when key criteria are validated.

A Note on Bitcoin Exchanges

The ins and outs of the blockchain, hash rates, and mining are not especially relevant to most Bitcoin network participants. Bitcoin owners who aren't part of the mining community buy their Bitcoin from a Bitcoin exchange. These are internet platforms that facilitate Bitcoin and other digital currency transactions.

Conclusion

Economists continue to debate how cryptocurrencies will transform the world. However, there is no denying the digital revolution of currency as a whole is well underway. The new system is likely to alter the entire definition of money. It is entirely possible that fiat currency may seem as obsolete as bartering a century from now. To learn more about how this may happen one day, continue on to read the next module, Blockchain Applications in Financial Services