Module 17: A Guide to Danaswap's Key Features

Module 17 will guide you through the key features of Ardana's decentralized exchange - Danaswap. You will learn more about stable pools, swaps, liquidity provision, foreign exchange, and much more.

Introduction

The last module looked at Ardana’s stablecoins, this module is about the key features of Danaswap.

Decentralized exchanges (DEXs) allow users to buy and sell cryptocurrencies in a peer-to-peer manner without the need for a broker. They were created to eliminate the need for a central authority to oversee and approve trading on a particular exchange. DEXs are generally non-custodial, meaning that users retain ownership of their private keys.

In order to begin trading through a decentralized exchange, users simply need to connect their crypto wallet to a DEX, such as Uniswap (CRYPTO: UNI) or PancakeSwap (CRYPTO: CAKE), select the desired crypto-crypto trading pair, for example, between Bitcoin and Ethereum, enter the amount and press the swap button. In addition, there are many more coins and tokens available on these exchanges, making them ideal for adventurous investors.

This is a popular crypto investment method that now accounts for a 3% market share in the emerging crypto finance space.

In this module, we will be taking a close look at Ardana's DEX - Danaswap. We will examine how it works, its unique features, and more.

Let's get started!

Danaswap

When Danaswap first launches, it will provide liquidity to stablecoins and later facilitate foreign exchange on Cardano. The protocol will support a range of currencies, including the US Dollar (USD), British Pound (GBP), and Euro (EUR).

Due to its high capital efficiency, one significant advantage for traders using Danaswap is that it ensures minimal slippage between the time a trade is logged and the trade execution while also providing low-risk yield opportunities for liquidity providers. Minimal slippage applies to trades up to six and seven figures.

This is possible because Danaswap is an automated market maker (AMM) that maintains a tight spread between assets in a liquidity pool by automatically adjusting the concentration of liquidity within a set range. As a result, swaps incur minimal slippage and fees with this method without impacting the liquidity providers' earnings.

Users who choose to trade on a decentralized exchange like Danaswap enjoy many advantages: retaining ownership of private keys, lower fees, access to easy-to-manage assets, and more.

Stable Pools

The Danaswap stable pool contains a collection of pegged assets. These asset sets are made up of assets that all trade at roughly the same price. So, unlike classic AMMs with constant products, stable pools concentrate most of the available liquidity around the current price point, making them a more effective trade execution platform for swaps.

Swaps

Swaps allow for the instant exchange of two different tokens belonging to two unique blockchain protocols without the need to initiate traditional crypto swaps or token migration. It will enable users to swap tokens/assets directly from the official private key wallet or trading account.

Swaps also allow seamless crypto-to-crypto exchanges, rather than a time-consuming and costly conversion of currencies to fiat currencies to buy the desired coin with the fiat currencies.

On Danaswap, swaps are completed through one of the liquidity pools. As a result, users can trade between two assets (assuming the respective pool supports both) and benefit from rapid and efficient transaction execution when the swap is conducted.

Liquidity Pools & Liquidity Provision

Essentially, a liquidity pool enables crypto traders and investors to access market liquidity in decentralized financial markets. Liquidity pools are a pool of funds contributed to a smart contract to provide liquidity to decentralized exchanges (DEX), lending and borrowing protocols, and other DeFi applications.

A liquidity pool can be thought of as a decentralized version of an order book powered by smart contracts.

Individuals or professional market participants who use their crypto assets to supply liquidity to a liquidity pool in order to allow the underlying DeFi protocol to function are known as liquidity providers (LPs).

For example, liquidity providers fund a smart contract on a decentralized exchange with two or more cryptocurrencies, usually in equal portions. This creates a market for that crypto pair, making it easier to trade.

Liquidity providers are rewarded with a share of the exchange's transaction fees, incentivizing them to offer liquidity. They are compensated in proportion to the amount of liquidity they contribute to the pool.

Liquidity providers (LPs) on Danaswap deposit their assets in Danaswap pools and act as market makers on the platform. LPs put up one or more of the pool's assets and immediately start receiving trading fees proportional to their stake in the pool. Please keep in mind that even if a liquidity provider only contributes one type of asset to the pool, it is still exposed to all of the pool's underlying assets and their price variations.

LPs can also contribute their LP tokens to the Ardana Rewards Enhancement Module (AREM), allowing them to engage in Ardana's liquidity mining activities and earn an extra $DANA return.

What are the Benefits of Liquidity Pools?

While joining a liquidity pool can be a challenge for cryptocurrency newcomers (at least at first), there are advantages.

Let's look at a few of these advantages below:

Liquidity pools guarantee that DeFi protocols, particularly decentralized exchanges and lending platforms, have enough liquidity.

Wealthy market makers are not the only individuals who can provide liquidity.

Liquidity providers have access to multiple layers of earning opportunities by deploying their liquidity provider tokens on other DeFi protocols.

Liquidity providers can participate in the decision-making of a protocol they provide liquidity to by earning governance tokens and using them to vote.

Traders can interact with liquidity pools in a trustless manner.

Danaswap's Pricing Algorithm

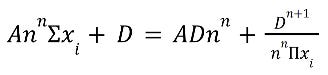

On Danaswap, the pricing algorithm for trades runs on invariant equations. There is one equation that must always hold for any contract (the invariant equation). We may get the price at which a specific trade would be conducted at a given moment by solving this equation after amending the relevant variables.

Here is Danaswap's pricing algorithm:

The invariant equation depicts how supply and demand affect the exchange rate between two assets, i.e., if the quantity of an asset I in the liquidity pool drops relative to the supply of other assets in the pool, the relative price of I rises, and vice versa.

Optimal Pool Proportion

Each asset in a stable pool consumes a certain percentage of the whole pool. The desired portion is known as the Optimal Pool Proportion (OPP).

If a user swaps with an unbalanced stable pool or renders it unbalanced by swapping, the user will be charged a rebalancing fee or bonus based on the effect of their swap on the optimal pool percentage.

In regards to swaps, this adjustment is achieved by modifying the number of output tokens for the swap based on the stable pool's ideal pool proportion. The rebalancing fees are calculated by subtracting the output of each swap that increases the variance of OPP within a stable pool. Rebalancing bonuses are added to the output of any swap that decreases the deviation from OPP within a stable pool.

Regarding liquidity providers, rebalancing fees are calculated by lowering the number of liquidity pool tokens received for each LP deposit, which causes a stable pool to deviate from its OPP.

The number of LP tokens obtained for each LP deposit that reduces a stable pool's departure from its OPP earns rebalancing bonuses.

A swap's fee or bonus calculation is based on the swap's effect on the deviation from the OPP. The higher the rebalancing charge for a swap that results in more deviation from the OPP, and the larger the rebalancing bonus for swaps that result in greater convergence of the pool to its OPP, the more unbalanced the pool is.

Danaswap's Foreign Exchange

As mentioned above, the Ardana protocol will offer a whole range of different currencies covering common trading currencies such as the US Dollar (USD), British Pound (GBP), and Euro (EUR), all of which will be generated as stablecoins on the platform.

There are currently only a few options to create stablecoins that are not tied to the US dollar on the blockchain. This means that a potentially large international user base will have to use a stablecoin in a foreign currency. There are stablecoins for currencies other than the US dollar, but they are not decentralized, relying instead on a trusted custodian to back these assets with their reserves.

Users will be able to manufacture stablecoins in various currencies and trade them on Danaswap, providing a quick, low-cost, and accessible international currency system.

Conclusion

Decentralized exchanges are an exciting addition to DeFi and are increasingly overtaking centralized exchanges in terms of popularity. Because DEXs are more complicated than central exchanges, they are geared toward more experienced users. Despite the fact that DEX users form vast communities, the user is given a higher level of accountability because they are in complete control of their own funds. Since there are no central servers, each user is solely responsible for the security and privacy of their transactions.

Because users have complete control of their digital portfolios, it is easier to share this information with potential buyers, which is one of the best benefits of a decentralized exchange.

In a world that is increasingly concerned about data, DEXs offer anonymity and grant users full access to their private keys, and users no longer need to undergo an authentication process.

If you are searching for a secure exchange with more advanced and exciting features, Danaswap is one of the most innovative options in the DeFi space.

In the final module, we will learn about forex trading and how this is possible with Danaswap.